Broker Smackdown and the International Broker Challenge are three-day programs designed to give emerging leaders an in-depth understanding of how the insurance brokerage business works, how it makes money, and how strategies and decisions impact financial, operational, and sales results. Participants gain a deeper understanding of their role in the big picture of the brokerage business and develop an appreciation for senior leaders’ decisions. They also enhance their understanding of the metrics that are important to the bottom line.

In teams of four, participants compete in a computer-simulated insurance brokerage market to experience an elevated level of decision-making with a bird’s eye view on the brokerage value chain – from customer segment analysis and lead source management to financial management and producer competency.

Broker Smackdown helped me understand my own strengths and how to draw from the strengths of my team.

Haendel Conil, Frenkel & Company

UPCOMING BROKER SMACKDOWNS

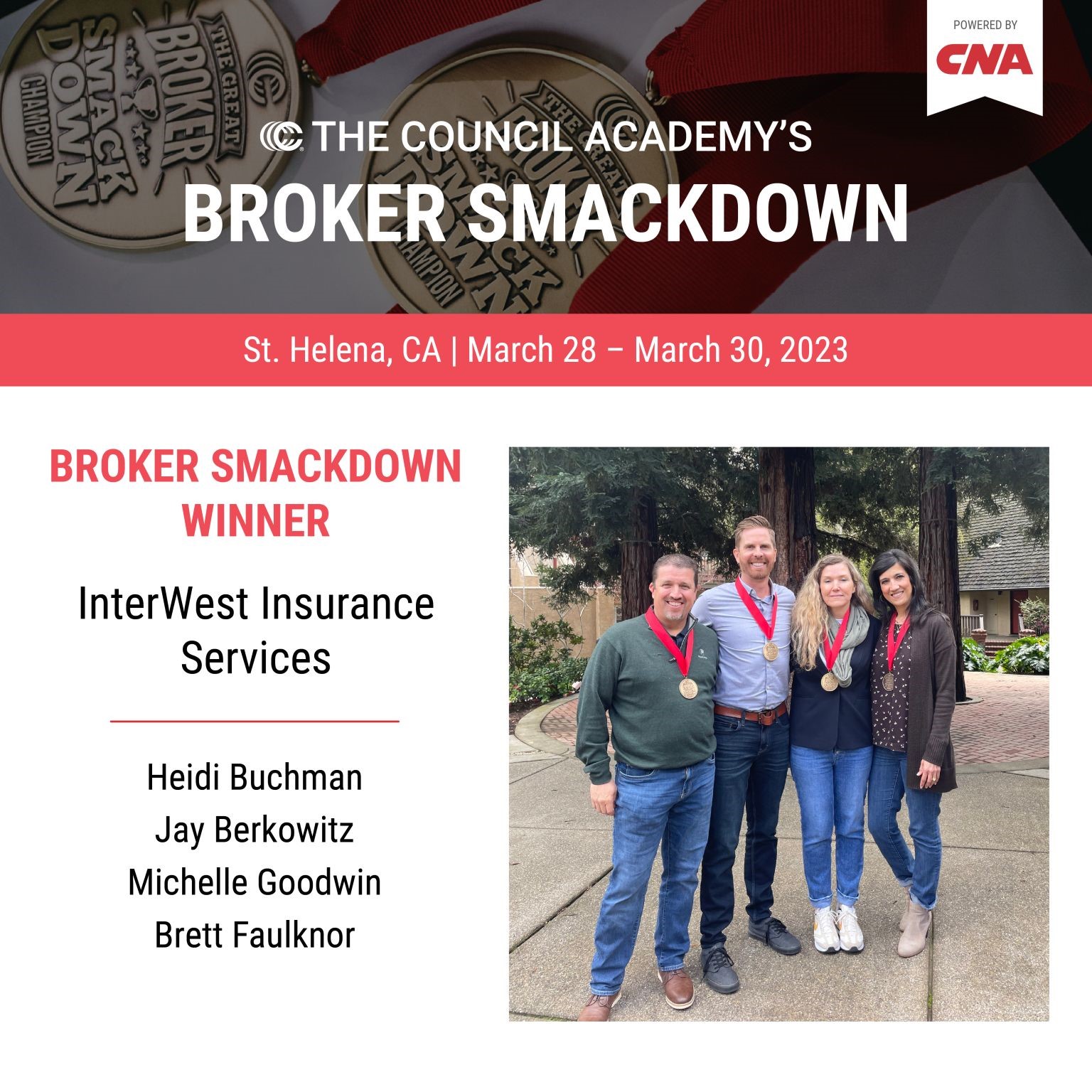

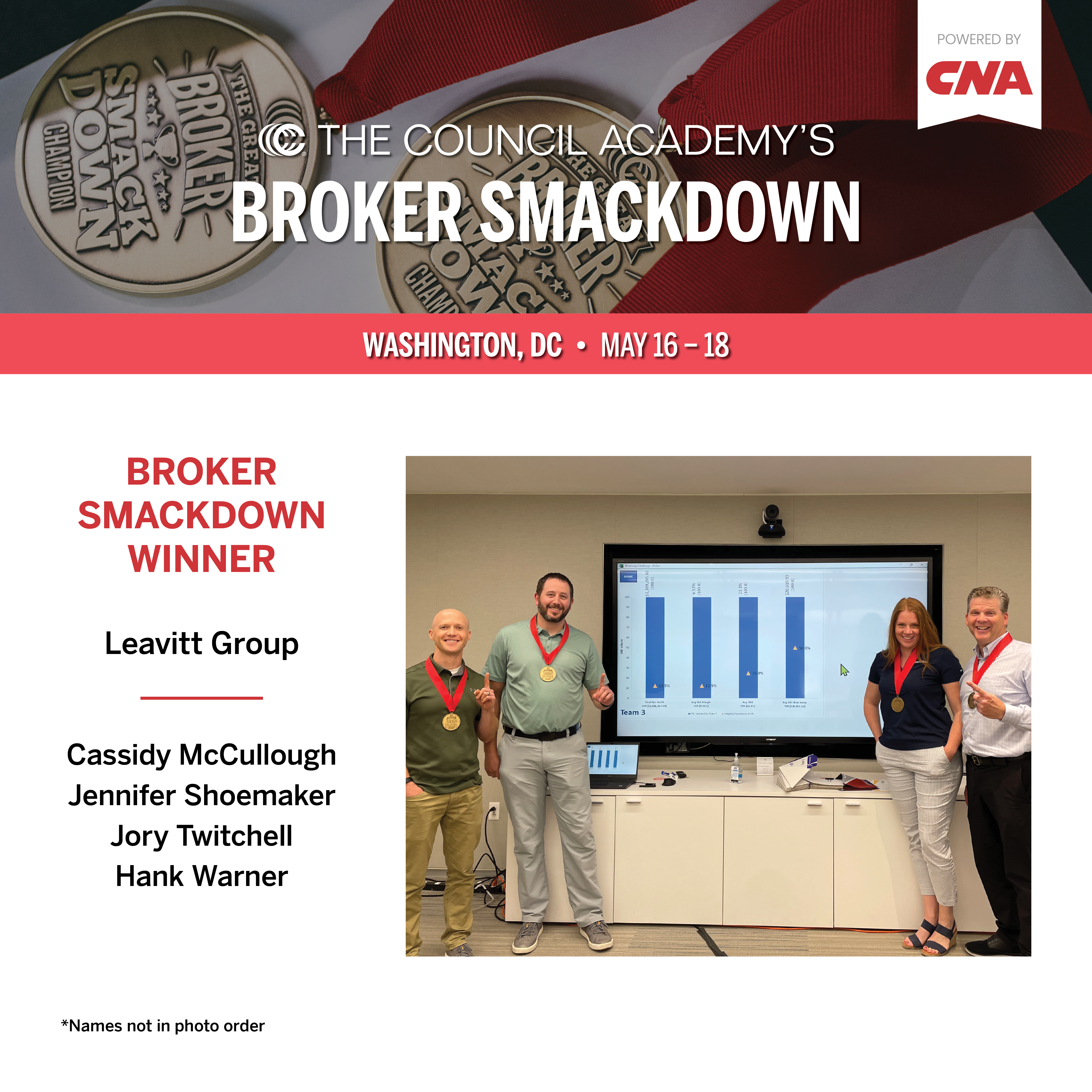

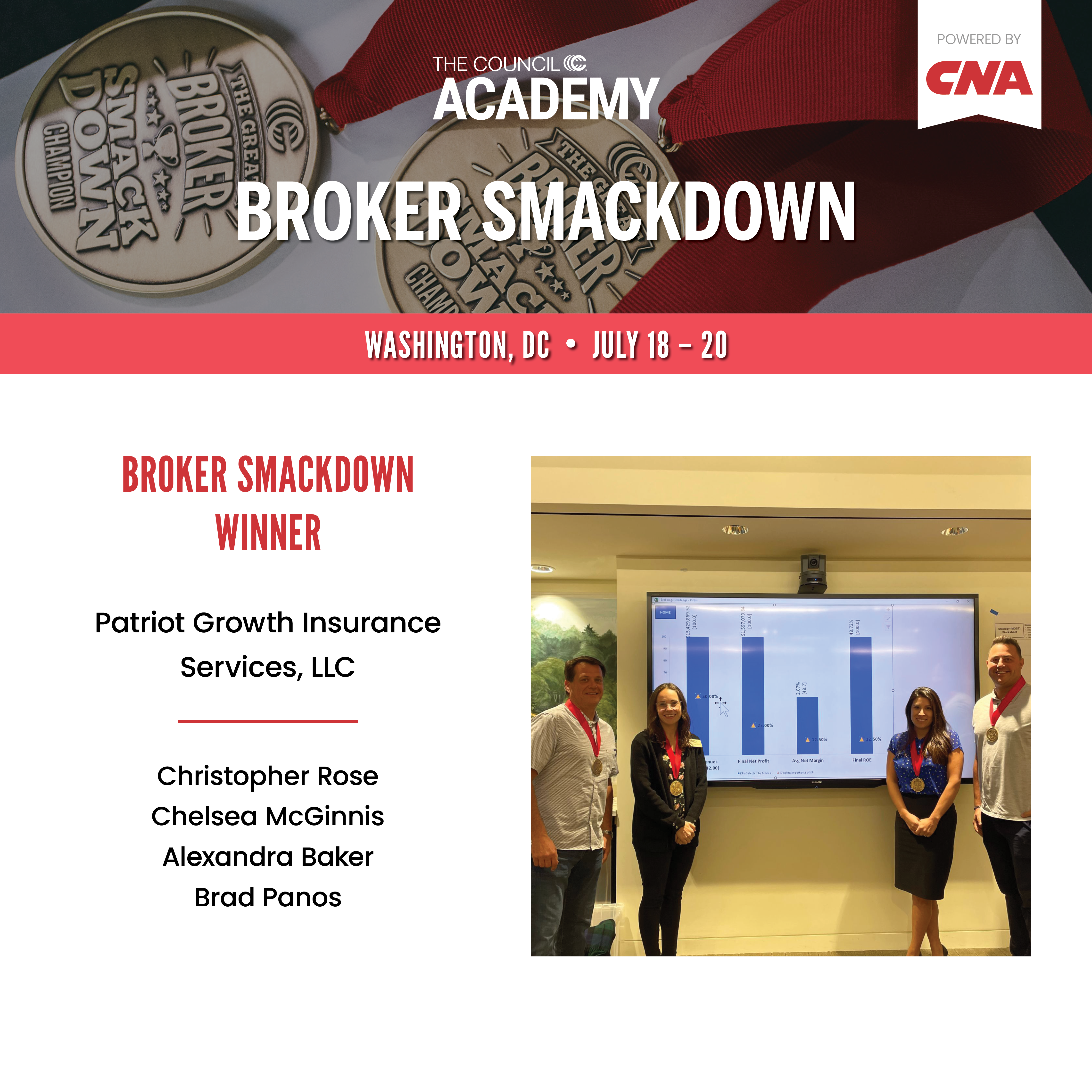

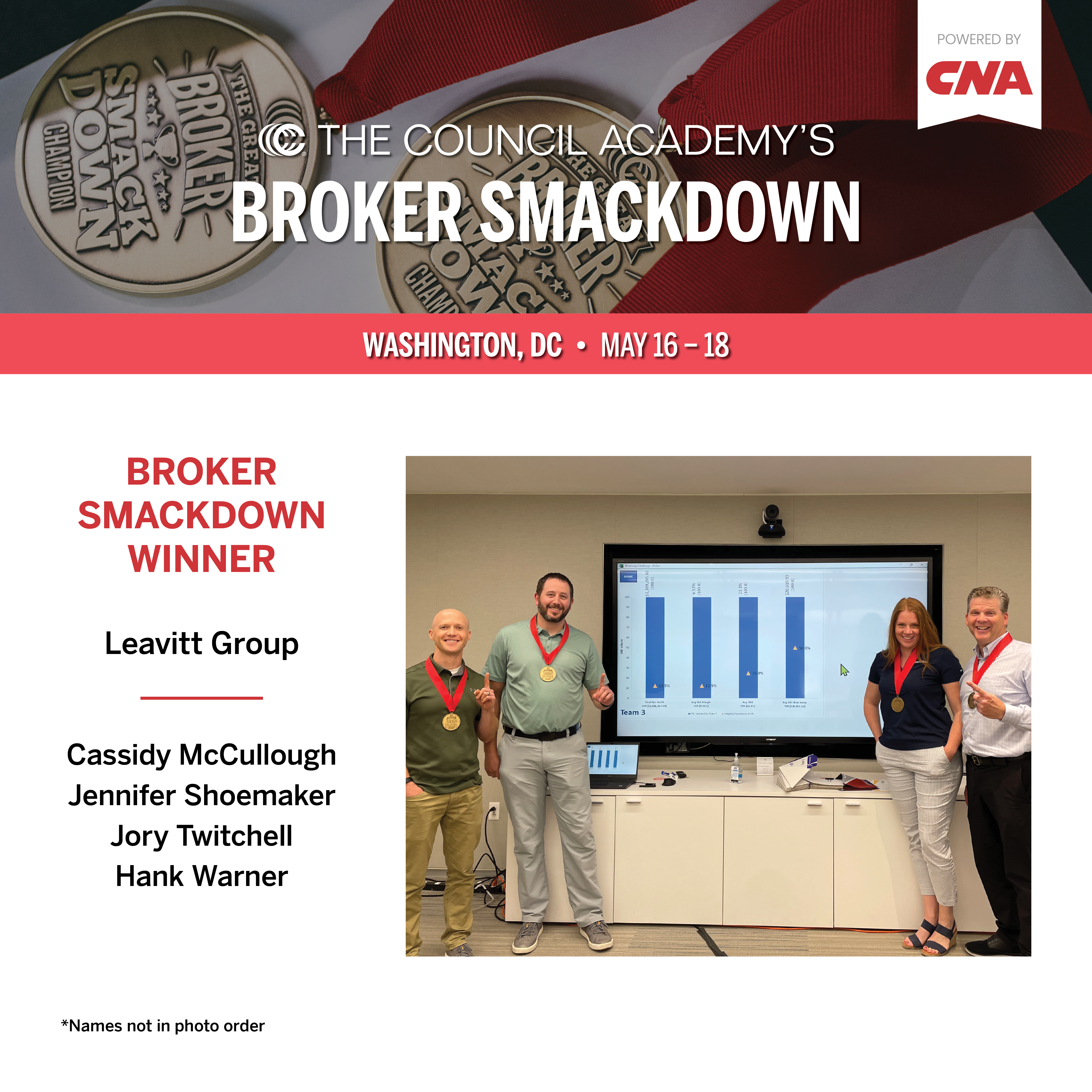

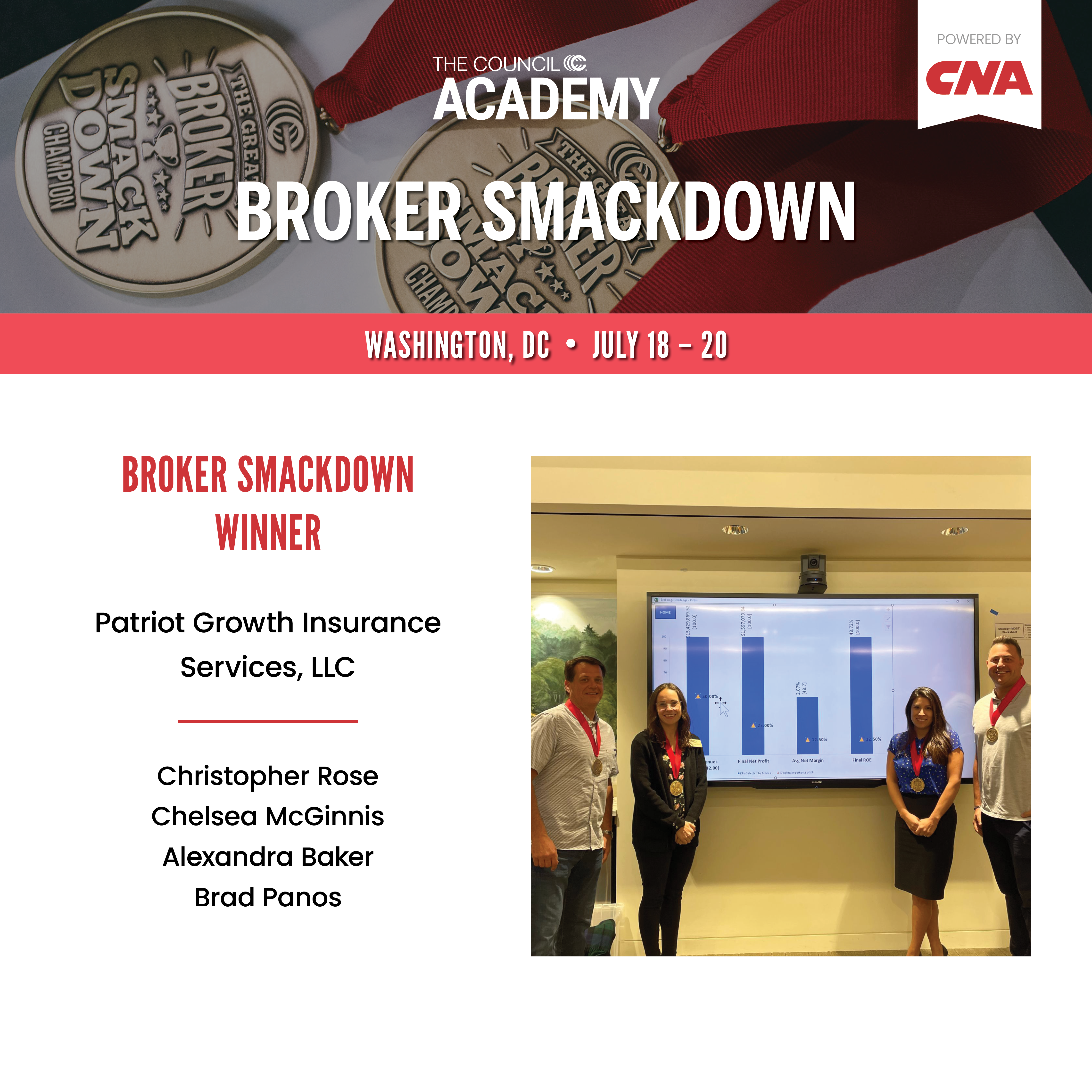

2023 BROKER SMACKDOWN & INTERNATIONAL BROKER CHALLENGE WINNERS

Broker Smackdown helped me understand my own strengths and how to draw from the strengths of my team.

Haendel Conil, Frenkel & Company

The program focuses on developing eight core competencies in three important categories:

Business

Business Acumen: Concepts, tools and processes that are needed for making sound decisions for the company’s business

Business Markets: Knowledge of existing and planned markets and market related initiatives from the perspectives of the competition, the suppliers, the customer base and the regulatory environment

Leadership

Strategic Thinking: Understanding “big picture” thinking and planning, and identifying and maintaining focus on key success factors

Goal-Setting: Creating goals that stretch the team’s capabilities and support business strategies

Accurate Interpersonal Assessment: Understanding the interplay of personalities within a group, and assessing the barriers and opportunities that come from it

Relationship Building: Creating positive team relationships by valuing others’ concerns and contributions

Interpersonal

Oral Communications: Ability to express oneself and communicate with others verbally

Collaboration: Ability to promote a culture of information-sharing, work together to solve business problems and meet business goals

Participants make decisions in the following areas:

Finance

Financial Management: debt, accounts receivable, working capital, float

Financial Ratio Analysis: profitability, productivity, liquidity, EBITDA, ROE and loss ratios

Competition

Competition for policy sales and renewal

Competitive analysis

Customer Management

Service levels, staff training, marketing investments

Customer satisfaction

Customer segment analysis

Profitability of each customer segment

Sales Office Decisions

Lead source management

Production analysis

Producer competency development

Carrier management

2023 BROKER SMACKDOWN & INTERNATIONAL BROKER'S CHALLENGE WINNERS

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.