Insurtech is technology-fueled innovation within the insurance industry. Its evolution has enabled the market to align with consumer behavior and expectations by leveraging technology, data and analytics.

The Council’s Insurtech Mission is to enhance broker members’ market understanding by offering forward-thinking insights through the adviser lens.

November 21, 2017

The word “insurtech” can cause reactions spanning from excitement, interest and eagerness to rejection, confusion and avoidance. All of these are valid as the industry is being inundated with information urging it to change, and at a rapid pace. However, insurtech is simply technology-fueled innovation within the insurance value chain. The term represents the range of products/services that are being used to propel or support the management of risk, whether by new startups or more established technologies.

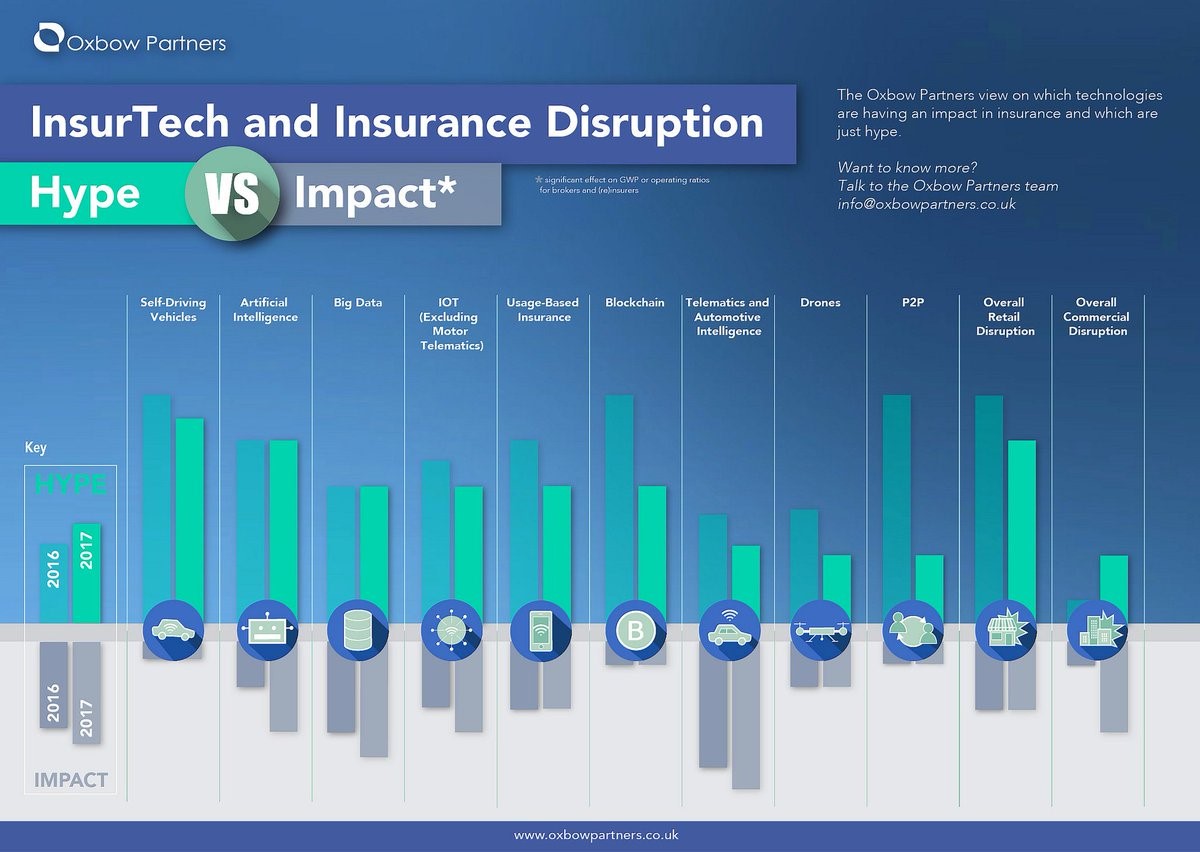

As the insurtech market continues to boom, as is demonstrated by the volume of new products/services competing for market share, it is a worthwhile exercise to see what has gained traction over the past year. Where is the hype versus impact barometer?

The chart above outlines the variance between market hype and impact between 2016-2017 for a handful of technologies touted to be significant innovators for the industry.

Overall, the level of perceived hype in the market decreased, while the impact stayed even or increased. Not surprisingly, the impact of artificial intelligence (AI), big data, IoT, telematics and automotive intelligence, and overall commercial disruption all increased in market impact. Does this demonstrate the power of these technological capabilities? Does this signal industry incumbents are understanding the power of collaborating with insurtechs that can power their business to new levels?

Looking Ahead

Which area on the chart do you think will have the most market impact in 2018? Weigh in via the two-question survey. Results will be shared in a future Insurtech Spotlight.

Hear More

The Council recently sat down with Martha Notaras, Partner at XL Innovate. Hear her insights on market trends and developments including her takeaways from the InsureTech Connect conference, advice for brokers aiming to become more data-driven, how XL Innovate evaluates potential insurtech investments, how the traditional value chain is evolving and how insurtech is affecting emerging markets.

What We’re Reading

Insurtech Startup Debuts with $6M and Proactive Cyber Risk Product

An insurtech startup debuts a proactive cyber risk product that monitors cyber policies for weaknesses and points of vulnerability. It also uses algorithms to price policies looking forward rather than historical events.

Insurtech Teams up with HUB and Miami Dolphins

A Canadian insurtech, nimbyx, Hub International and the Miami Dolphins are partnering to bring a new insurance experience to fans.

Beyond hype. Blockchain shifts up a gear

Blockchain shifts up a gear. UK based ChainThat received “multi-million dollar” funding last week from Xceedance. This, along with B3i announcing 23 more participants in October and R3 announcing a $107 million investment, may show blockchain is in line to make an impact sooner than originally thought.

Essentially disruption can be broken down into three simple things – ease of use, engagement and data.