NEWS RELEASE – FOR IMMEDIATE RELEASE

Contact: Brianne Spellane

Director of Communications & Content Strategy

202.662.4303

brianne.spellane@ciab.com

PREMIUM PRICING CONTINUES TO DECLINE IN Q2 2017,

ACCORDING TO CIAB MARKET SURVEY

WASHINGTON, D.C. – August 17, 2017 – Commercial property/casualty (P/C) rates continued to decline for the ninth straight quarter, according The Council of Insurance Agents & Brokers’ Commercial P/C Market Survey.

The average rate decline across all sized accounts was -2.8 percent, similar to the -2.5 percent decrease in Q1. While premium pricing saw its greatest decline throughout 2016 (-3.9 percent), the market appears to be stabilizing in 2017. Large accounts once again experienced the largest rate decreases (-4.3 percent) compared to an average of -2.8 percent for small, medium and large accounts combined.

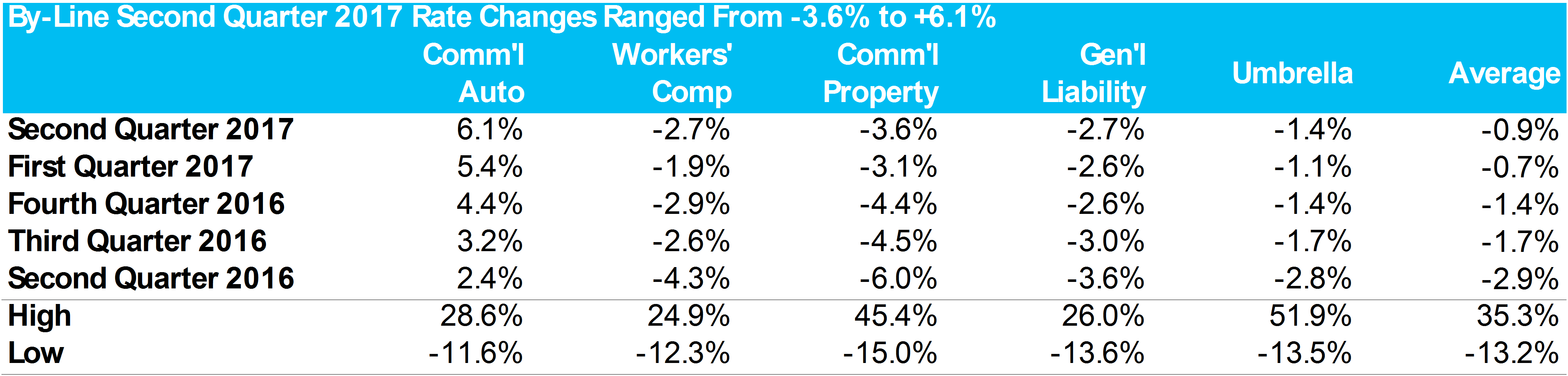

By-Line Second Quarter 2017 Rate Changes Ranged From -3.6% to +6.1%

Source: The Council of Insurance Agents & Brokers. Chart prepared by Barclays Research

“While premium pricing in commercial auto continued to go against market trends, most other lines remain soft but appeared to be flattening to some extent,” explained Ken A. Crerar, President & CEO of The Council. “In response to a soft and competitive market, we also saw carriers opt towards improving terms and conditions over dropping premium rates.”

The soft market also saw a decline in rates for most lines of business (LOB) with workers’ comp, commercial property and general liability experiencing the largest rate decreases. The average rate change in premium pricing across all lines this quarter was -.8 percent. On the other hand, commercial auto saw its highest rate increase since the trend began in 2011 with a 6.1 percent increase this quarter. The majority of respondents also agreed that the market remained competitive this quarter with plenty of capacity.

Once again, attracting and retaining talent was a consistent trend this quarter among companies of all sizes. Talent management was the number one business concern for respondents, followed by price competition/excess capacity, uncertainty in health insurance reform, and data security.

When asked about organizations’ top investments right now, producer talent was overwhelmingly the first choice. While many respondents noted that “all the above” are key investment strategies, technology platforms and data analytics are key focuses as well.

“We are seeing firms make numerous investments into areas such as InsurTech and data analytics, as well as attracting young talent into our industry. The Council has made both of these areas lead priorities,” said Crerar.

To read the full results, please click here.