NEWS RELEASE – FOR IMMEDIATE RELEASE

Contact: Brianne Spellane

Director of Marketing & Communications

202.662.4303

brianne.spellane@ciab.com

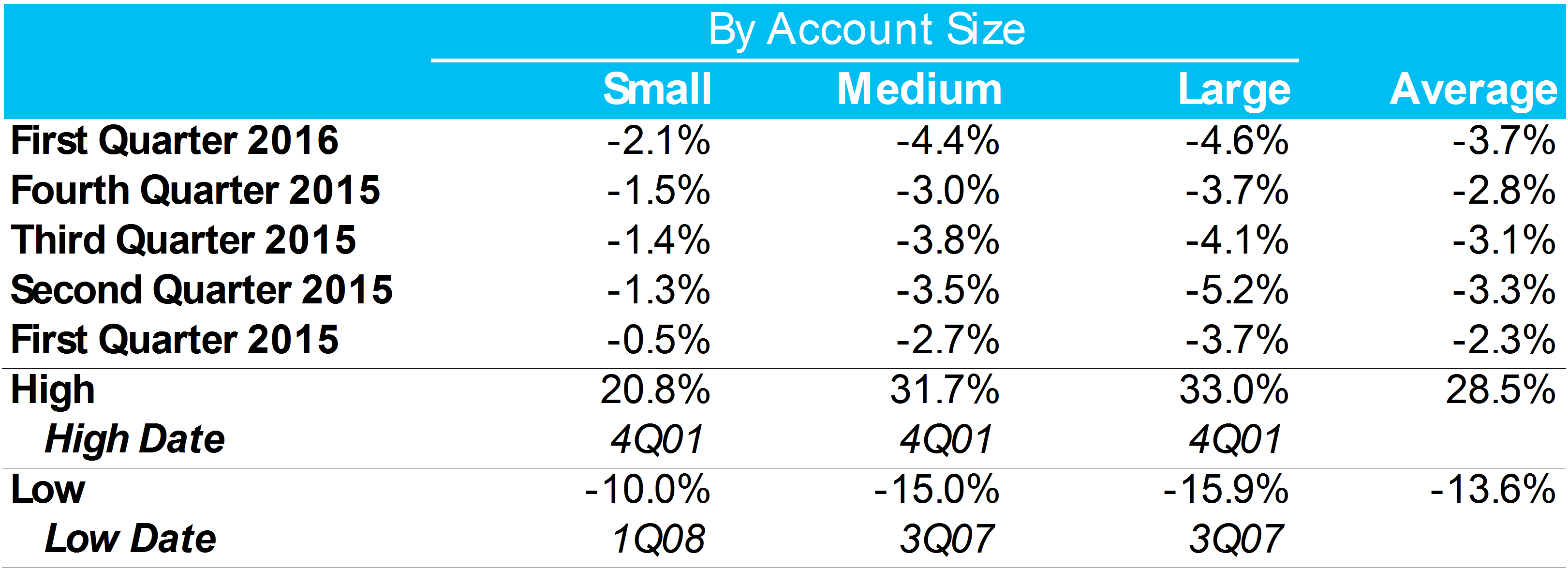

WASHINGTON, D.C. – May 3, 2016 – The Council of Insurance Agents & Brokers released today the results of its Commercial P/C Market Index Survey for the first quarter of 2016. According to survey respondents, commercial property/casualty rates decreased across all size accounts in the first quarter of 2016, continuing a trend in the market since the first quarter of 2015. Rate decreases in Q1 were the largest seen since the trend began, with the exception of large accounts in Q2 2015 which decreased by 5.2 percent compared to the previous quarter.

“It does not come as a surprise that the soft market conditions we’ve seen over the past year have continued in the first quarter of 2016,” said Ken A. Crerar, president/CEO of The Council.

Average First Quarter 2016 Commercial Pricing

Source: The Council of Insurance Agents & Brokers. Chart prepared by Barclays Research.

First quarter rates decreased by an average of 3.7 percent. Large accounts decreased at -4.6 percent, followed by medium-sized accounts at -4.4 percent and small accounts at -2.1 percent. One respondent from the West coast explained that, “Carriers were working hard not to lose their renewals. [They were] trying to put accounts to bed early if they could before they hit the market.”

The decline in rates was consistent across most lines, with the exception of commercial auto, which increased 3.6% in the first quarter and has been increasing steadily since the third quarter of 2011. One broker in the Southeast noted that, “Auto is getting difficult to place with loss activity.” Another from Florida commented that “Auto was the only line pushing (and obtaining) rate increases. But there are still some competitive carriers who were writing auto because they were confident in their pricing.” Directors & Officers Liability and Employment Practices Liability lines also saw a very slight uptick in rates of 0.2 percent and 0.7 percent respectively.

“While rates have been down, our members have told us that the market has increased capacity across the board and for coastal property coverage, particularly in the Southeast region,” said Crerar. “We have been fortunate to have quiet hurricane seasons the last few years, but there is a lot of concern that these new markets will retreat after the first major loss event.”

One regional broker in the Southeast agreed that, “Coastal property capacity continued to increase.” Another respondent from Tennessee commented that “capacity continued to increase on most all lines of coverage. The only restriction we saw was in the trucking area.”

While this increased capacity has kept rates low, buyers have shown interest in purchasing additional coverages, such as cyber. One respondent in Georgia explained that “premium savings opened up cross-selling opportunities and clients were looking at additional coverages.”

Additionally, respondents were asked to name the top developments in the industry that they believe have and will impact their business. They cited the following:

- The economy

- The price of oil

- Carrier and broker consolidation

- Cyber — risk and educating producers and clients

- Recruiting and retaining talent

“The continued impact of crude oil prices and the trajectory of the global economy weighed on our members’ sentiment at the start of 2016,” said Crerar. “Elevated economic volatility is likely to continue but our members are positive about the opportunities that lay before them to make up for the effects of the oil downturn felt most intensely by brokers in the last quarter of 2015.”

The Council’s survey is the oldest source of commercial property/casualty market conditions, pricing practices and trends, dating back to 1999.