NEWS RELEASE – FOR IMMEDIATE RELEASE

Contact: Brianne Spellane

Director of Communications & Content Strategy

202.662.4303

[email protected]

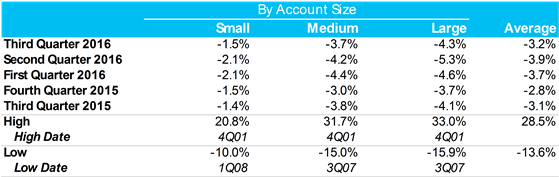

WASHINGTON, D.C. – November 1, 2016 – Commercial property/casualty rates decreased across all size accounts once again, according to The Council of Insurance Agents & Brokers’ Commercial P/C Market Survey for the third quarter of 2016. The average decrease was -3.2 percent which is a slight increase from -3.9 percent in Q2. Large accounts once again saw the largest decreases at -4.3 percent, followed by medium-sized accounts at -3.7 percent, and small accounts at -1.5 percent.

Source: The Council of Insurance Agents & Brokers. Chart prepared by Barclays Research

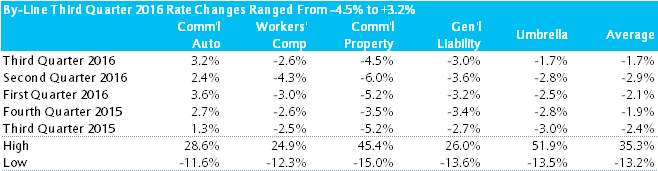

Rates decreased across most lines, except Commercial Auto and Employment Practices Liability, which was also consistent with Q2. Commercial Property saw the biggest rate decreases at -4.5 percent, followed by General Liability at -3.0 percent and Workers Compensation at -2.6 percent. Commercial Auto continues to be very difficult to place as carriers lack the appetite to take on additional exposure in that line and many are actively trying to shrink their exposure. Commercial Auto rates increased once again by 3.2 percent and Employment Practices Liability increased slightly by 0.3 percent.

One broker from the Southeast region expanded upon what they saw in the Commercial Property market. “Property continued to be soft. Large schedules [received] lots of attention along with more flexibility in deductibles relating to Wind/CAT exposures.”

By-Line Third Quarter 2016 Rate Changes Ranged From -4.5% to +3.2%

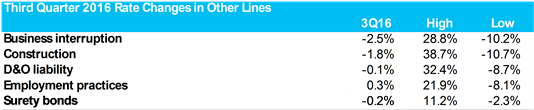

Rate Changes in Other Lines

While Workers Compensation rates continued to decrease, one broker from the Midwest cautioned that this may change as “cost shifting from group health claims to workers comp has really ramped up in the last six months.” The 14.5 percent rate increase that was approved in Florida may also have an impact on workers comp rates in the Southeast region moving into 2017.

The Council surveyed members on where they are making investments in their property/casualty business units and where they are providing additional value to their clients. Responses showed that brokers are placing a huge emphasis on talent—recruiting, training and retaining—within their firms. They are also adding value to their clients, beyond just placing coverage, by providing claims and loss control services. One broker in California confirmed, “We are focusing on the next generation of producers. We continue to offer our clients comprehensive claims management and risk management services.”

“Next quarter we’ll be keeping an eye out for two things: first, whether rates continue to decline even more as carriers aggressively compete to renew accounts and lock in new business as they look to close out the year strong. Second, what impact Hurricane Matthew has on property rates, especially in the Southeast region,” said Crerar.

The Council’s survey is the oldest source of commercial property/casualty market conditions, pricing practices and trends, dating back to 1999.