NEWS RELEASE – FOR IMMEDIATE RELEASE

Contact: Brianne Spellane

Director of Communications & Content Strategy

202.662.4303

[email protected]

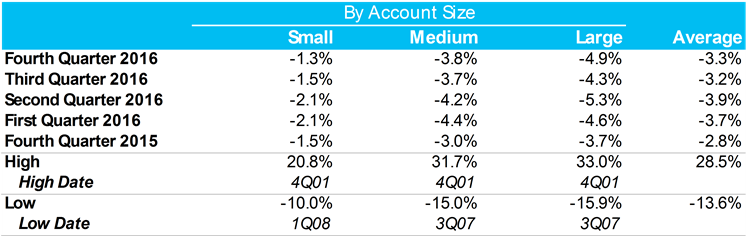

WASHINGTON, D.C. – February 2, 2017 – Commercial property/casualty (P/C) rates declined in Q4 across small, medium and large accounts for the eighth straight quarter, according to The Council of Agents & Brokers’ Commercial P/C Market Survey. The average rate decrease was 3.3 percent, which is consistent with the third quarter’s 3.2 percent decrease. Large accounts again saw the largest decrease at 4.9 percent, followed by medium accounts at 3.8 percent and small accounts at just 1.3 percent.

While this rate decrease began slowly during the fourth quarter in 2014, premium pricing saw the greatest decline throughout 2016. However, survey respondents noted that the decrease in rates in the fourth quarter were fairly consistent with Q3 2016, signaling some stability in the market. One broker from a mid-market firm on the east coast noted that the continuation of the soft market is no surprise, as increased competition puts downward pressure on premium pricing.

Average Fourth Quarter 2016 Commercial Pricing Declines

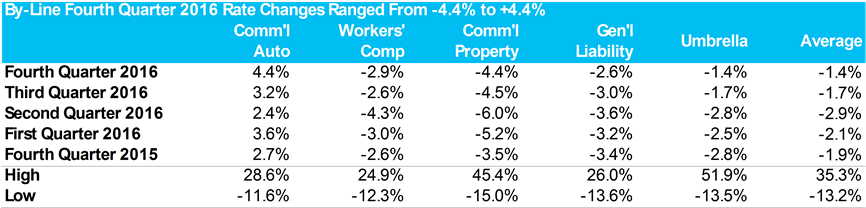

“While premium rate decreases have been steady throughout the past two years, there is normalization in the market across most lines of businesses,” said Ken A. Crerar, President/CEO of The Council. “However, Commercial Auto continues to harden and go against these trends.”

By-Line Fourth Quarter 2016 Rate Changes Ranged From -4.4% to +4.4%

Several key market trends were also noted this quarter. Many respondents said that carriers were underwriting new businesses very aggressively, often putting incumbents at an inferior position. “While renewal pricing is closer to being flat,” one broker explained, “new business pricing is more aggressive and softer.” Other carriers were writing accounts with tough losses, leading to more coverage across the board.

When asked which business issues kept them awake at night, talent management was overwhelmingly selected as the first choice. Price competition/excess capacity came next, followed by increasing cost of business (i.e. regulation, compliance, other).

The Council surveyed members about their organizations’ top one or two investments in Q4 and the overall consensus was again, talent and technology. Firms tend to be investing in new producers (inside and outside of the industry), young talent, stronger analytics and InsurTech, which has been the talk of the industry in 2016. As outside players begin to enter the world of insurance, primarily those in the tech space, respondents remain optimistic that investments in technology and InsurTech present more opportunities than challenges.

Lastly, respondents also tended to be optimistic about the uncertain future. “Brokers are optimistic about the prospect of increased federal spending on infrastructure, a shift in the corporate the tax structure and the downstream benefits from potential deregulation, particularly in the financial services and the energy sectors,” said Crerar

The Council’s survey is the oldest source of commercial property/casualty market conditions, pricing practices and trends, dating back to 1999.